how to calculate cash assets

Depreciation on Buildings Vehicles Acc. It deals with the current assets.

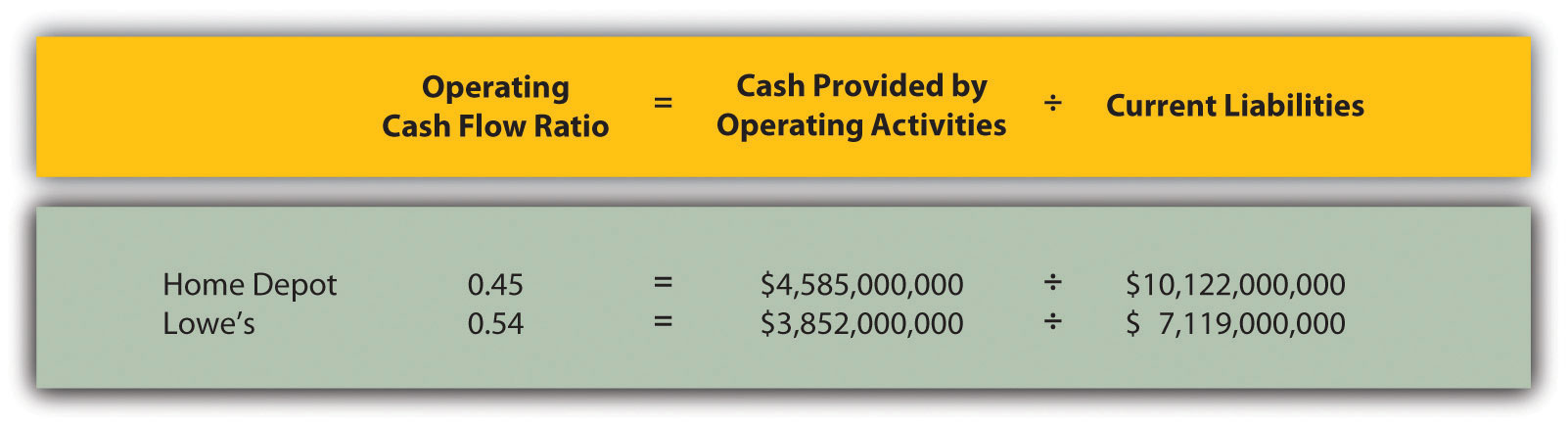

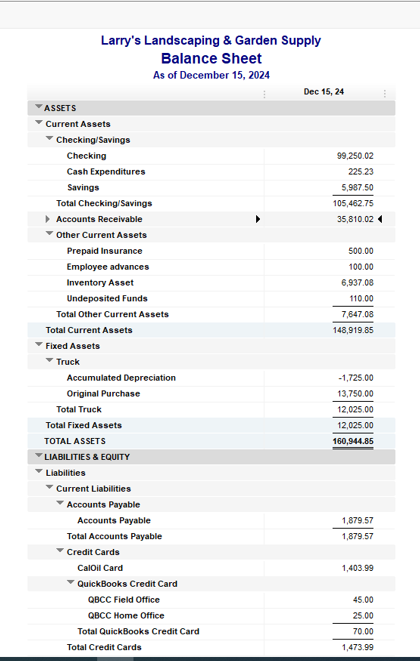

Analyzing Cash Flow Information

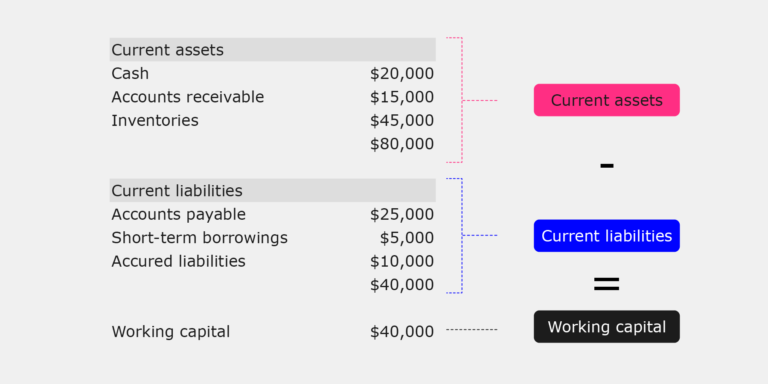

Current Assets Cash Cash Equivalents Inventory Accounts Receivables Marketable Securities Prepaid Expenses Other Liquid Assets Current Assets 6000.

. This results in the following cash flow from assets calculation. You can view the financial health of a business by using a basic accounting formula. It can also help you to counter-check your total assets figure.

Net fixed assets total fixed assets - accumulated depreciation liability The net fixed assets of a company are equal to its total or gross fixed assets minus the. Total assets current assets non-current assets or Total assets total equities total liabilities Total. Scanning the list you note that.

Add the value of anything you own that you can sell for cash in the future. Deduct the amount paid for new fixed assets from the cash receipts received from sold fixed assets. It also forecasts what will be the growth of business in the future.

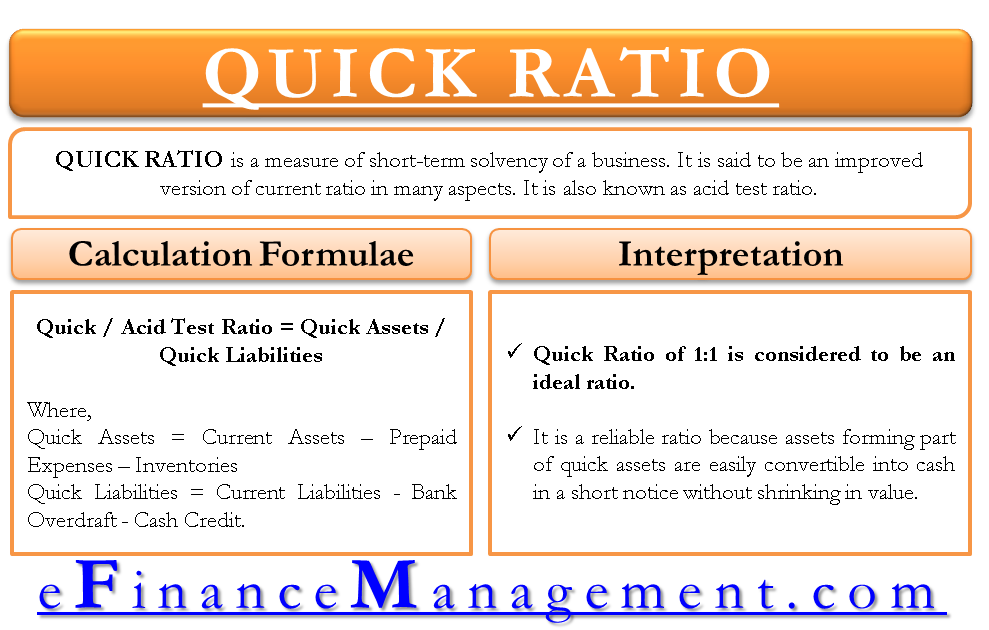

Compared to the current ratio and the quick ratio it is a. Non-cash working capital is the Financial term that indicates a business is profitable or not. Operating cash flow capital spending and change in.

How to calculate total assets. If you are going to buy more. Here are a few steps for calculating total assets.

Calculation The first step in calculating the cash flow from assets would be a separation of assets into two types. Current assets cash and equivalents accounts receivable inventory short-term investments prepaid expenses other liquid assets 2. The direct method lists and adds all of the cash transactions including payroll.

24000 -10000 2000 16000 Johnson Paper Companys cash flow from assets for the previous year is. The difference -- whether positive or negative -- represents the. There are two different methods that can be used to calculate cash flow.

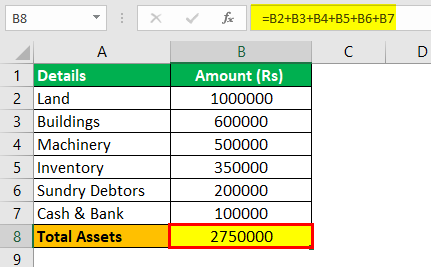

Depreciation on Machinery Inventory Sundry Debtors. Add the three amounts to determine the cash flow from assets. Total Assets is calculated as Therefore Total Assets Land Machinery Cash Total Assets 20000010000050000 Total Assets 350000 Balance Sheet The balance sheet is used to.

Depreciation on Vehicles Machinery Acc. Total Assets Land Buildings Acc. Cash flow from assets is the total cash flow to creditors and cash flow to stockholders consisting of the following.

The cash ratio is a liquidity ratio that measures a companys ability to pay off short-term liabilities with highly liquid assets. You may calculate total assets using one of the following formulas. Free Cash Flow Net income DepreciationAmortization Change in Working Capital Capital Expenditure Operating Cash Flow Operating Income Depreciation Taxes.

12000 Cash flow generated by operations 10000 earnings 2000 depreciation -25000 Change in.

Understanding Net Worth Ag Decision Maker

Accounting Equation Expense And Collection Accountingcoach

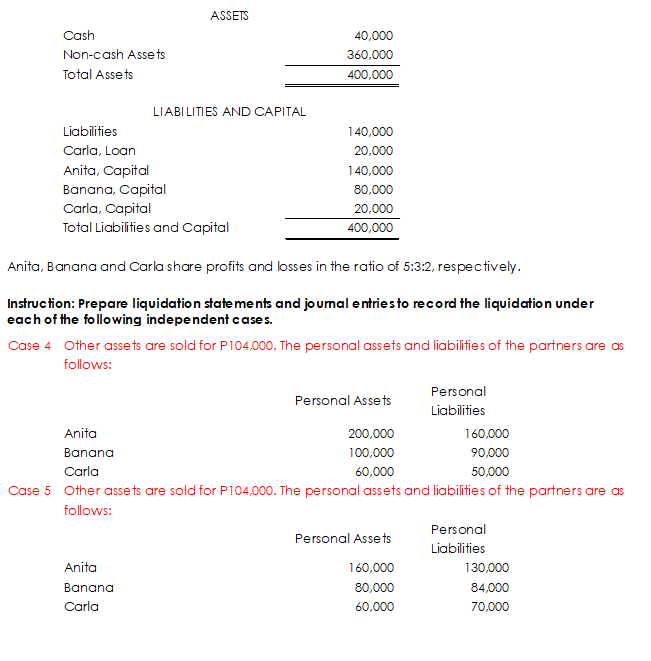

Assets Cash Non Cash Assets Total Assets 40 000 Chegg Com

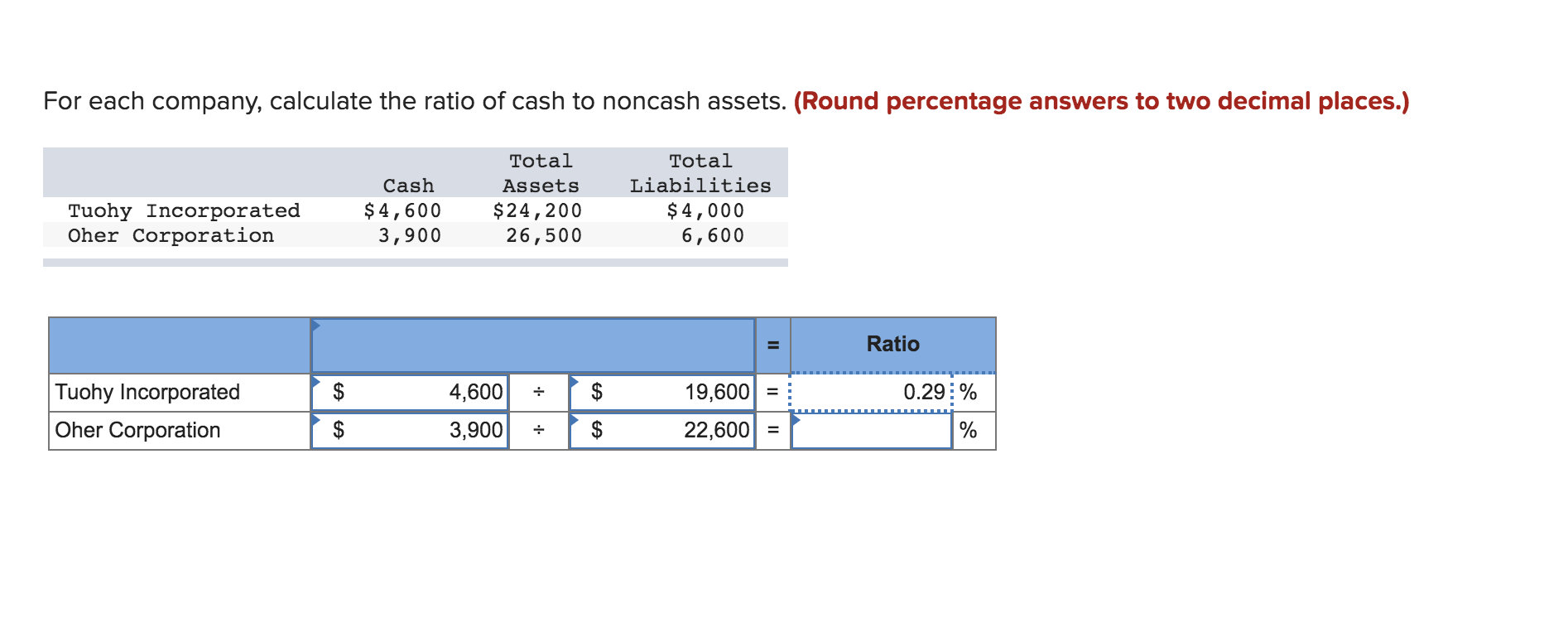

Solved For Each Company Calculate The Ratio Of Cash To Chegg Com

How To Calculate Asset To Debt Ratio 12 Steps With Pictures

How To Calculate Cash Flow 3 Cash Flow Formulas Calculations And Examples

Quick Ratio An Acid Test Of Short Term Solvency Of A Business

:max_bytes(150000):strip_icc()/calculate-cash-conversion-cycle-393115-v4-JS2-869f1dcda7b744abb1b815b2fd25c031.png)

Calculating The Cash Conversion Cycle Ccc

Should Accounts Receivable Be Considered An Asset Billtrust

How To Calculate The Quick Ratio Examples

3 4 Reporting A Balance Sheet And A Statement Of Cash Flows Financial Accounting

Understanding Net Worth Ag Decision Maker

Solved Question 9 0 5 Pts Select Financial Information Chegg Com

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)

Current Ratio Explained With Formula And Examples

Asset Turnover Ratio Formula Example How To Calculate Asset Turnover Ratio Video Lesson Transcript Study Com

Computing Acquisitions Sales Of Plant Assets Youtube

Total Assets Formula How To Calculate Total Assets With Examples

Solved Consider The Following Abbreviated Financial Chegg Com